xAI and Tesla founder Elon Musk says the United States has no other peaceful option than to turn to AI and robotics to address its swelling national debt.

In a new interview with podcaster Joe Rogan, the richest man on the planet says the US is past the point where traditional cost-cutting and incremental reform will be enough to stabilize government finances.

Musk warns that the US must regulate and adopt AI and robotics quickly to avoid a situation where it is forced to subjugate other countries to keep its finances under control.

“This is crazy. So even if you implement all these savings, you’re only delaying the day of reckoning for when America goes bankrupt. Unless you go full Genghis Khan, which you can’t really do. So I came to the conclusion that the only way to get us out of the debt crisis and to prevent America from going bankrupt is AI and robotics.”

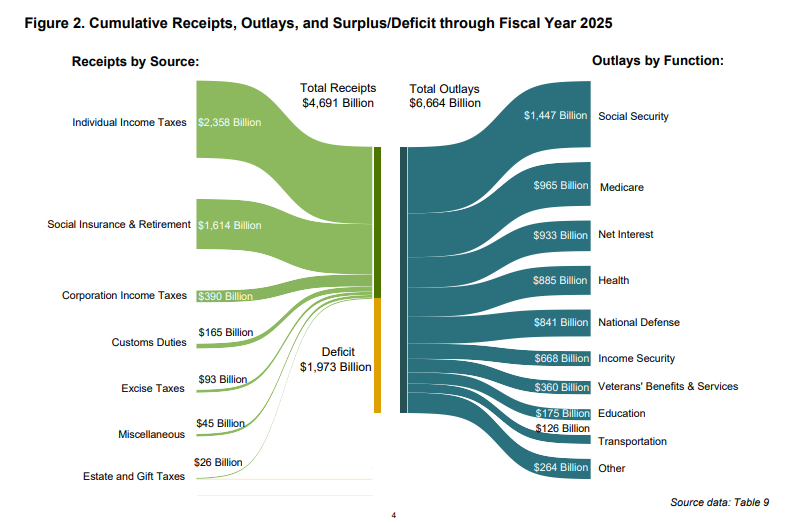

The latest data from the U.S. Treasury Department shows that the country’s national debt is at an all-time record of $38,108,930,250,279. As of the end of August, the US shelled out $933 billion to pay the interest on its rapidly growing national debt, higher than its $841 billion national defense spending, for the 2025 fiscal year.

Musk also says Social Security is flashing a warning light, citing official government messaging that full benefits may not be sustainable without major changes.

“Social Security will not be able to maintain its full payments, I think, by 2032. So Social Security will have to start reducing the amount of money that’s been paid to people in about seven years.”

The billionaire notes that in the coming years, the US will need to massively increase its GDP through AI and robotics to avoid bankruptcy.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.