A prominent venture capitalist dismisses AI bubble talks, arguing that current valuations bear little resemblance to the excesses of the dot-com era.

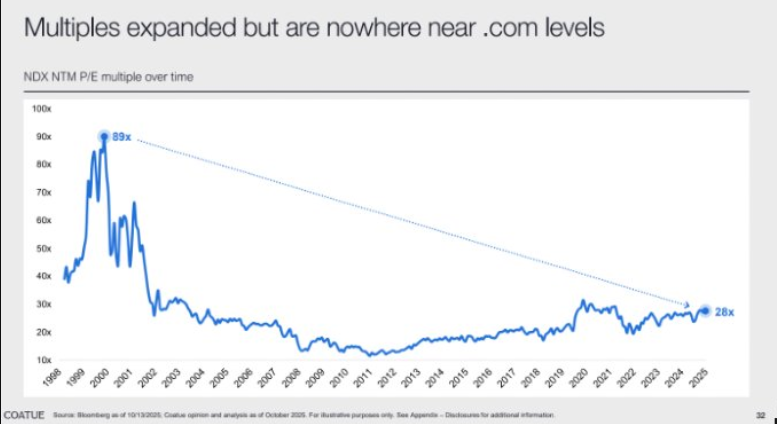

In a new post on X, Menlo Ventures executive Deedy Das cites data from the Coatue Oct 2025 State of AI Report to show that the AI trade is less than half of the multiples witnessed during the late 1990s dot-com bubble.

“Multiples (P/E) are nowhere near the .com level.”

Looking at the chart, the Nasdaq’s price-to-earnings multiple appears to have soared to 89x by 1999. In comparison, the same measure clocks in at 28x today.

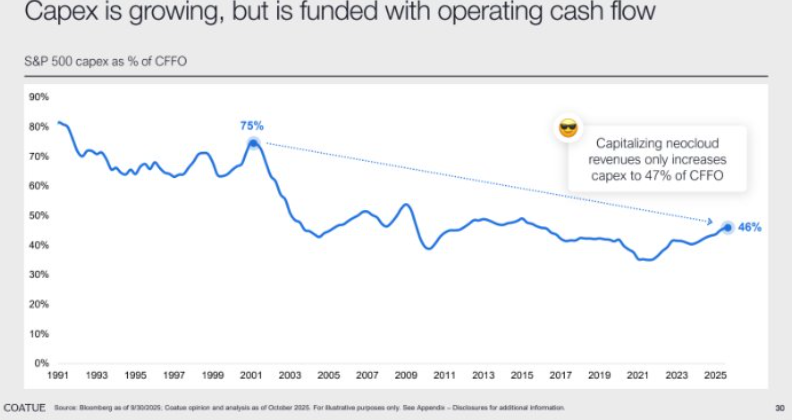

Turning to capital expenditures (CapEx), Das notes that while the metric is on the up and up, it is funded by cash flow and not debt.

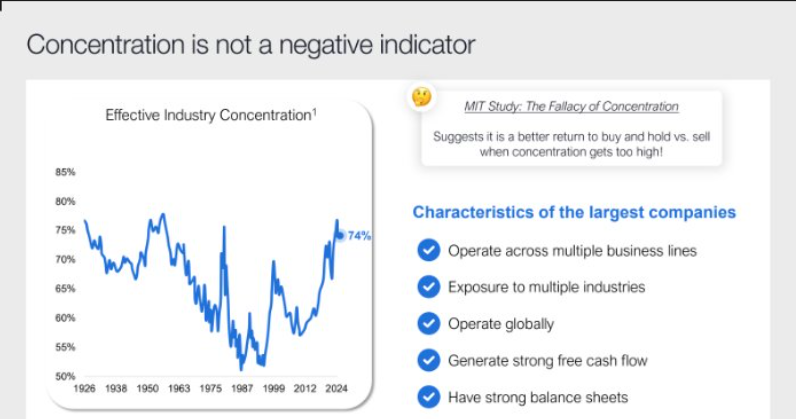

Another widespread concern is the market leadership of Mag 7 stocks. According to Das, the “concentration in the market isn’t necessarily negative.”

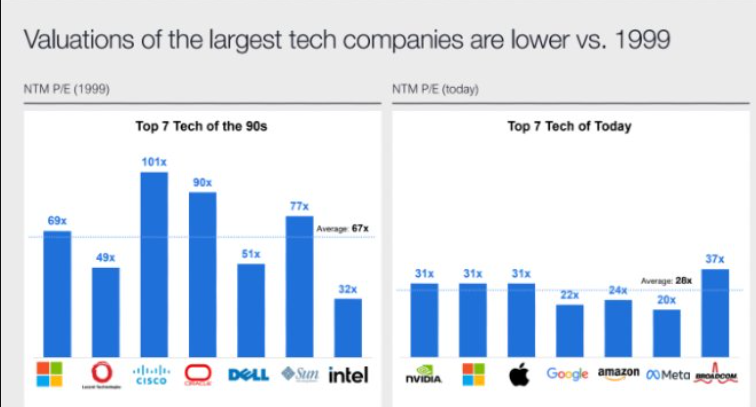

Lastly, Das notes that valuations in the biggest tech names today are far lower than the levels seen in 1999.

Earlier this week, Lauren Taylor Wolfe, managing partner at Impactive Capital, warned that AI is “definitively” in bubble territory. She said the imbalance between projected capital spending and real cash generation is unsustainable, believing that tech giants will have no other choice but to use leverage to pay for financial commitments.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.