A top strategist at Fidelity says the latest surge across AI stocks, gold and Bitcoin may be more than just a coincidence, as he sees the trades as a sign of eroding trust in the US dollar.

In a new post on X, Jurrien Timmer, the director of global macro at Fidelity Investments, says both hard assets and digital ones are gaining traction as the world transitions from a US-led monetary order to a multipolar one.

“Another major feature of the markets these days has been the relentless rise in the price of gold, joined by silver and, of course, Bitcoin. As the brilliant Eric Peters of One River Capital points out, perhaps gold (and by extension Bitcoin) and AI are interconnected in a way.”

Timmer says he believes the rallies in the asset classes reflect investors’ concern about rising geopolitical risks.

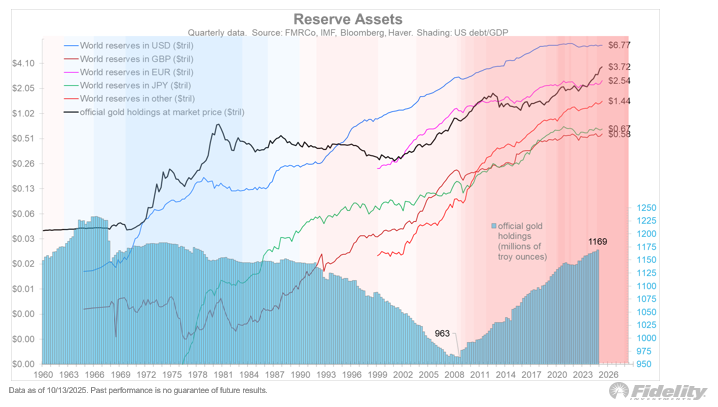

“As the world becomes more fragmented as it evolves from the unipolar system of the post-war era to a more fractured multipolar era, gold is in demand as countries strive to diversify themselves from the US reserve currency hegemony. We can see below that the share of reserve assets held in gold has been steadily increasing and is now as big as reserves held in euros. Hard money is taking share from fiat money, and the dollar is losing market share against gold.”

Timmer also points to parallels between commodity demand and AI geopolitics.

“At the same time, the demand for the ingredients that fuel the AI machine is also global, as AI dominance by the US might become a national security concern for other countries.”

According to the Fidelity executive, the surge of AI stocks, Bitcoin and gold may seem disconnected, but in reality, he notes that the trades have one underlying play.

“Put them together and you have two seemingly independent themes that might be somewhat connected in this new world order. Maybe this is why gold, the Mag 7, and Bitcoin, all occupy space well north of the efficient frontier?”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.