Fundstrat’s Tom Lee says Ethereum (ETH) may be entering a defining cycle that could propel its value to far greater heights.

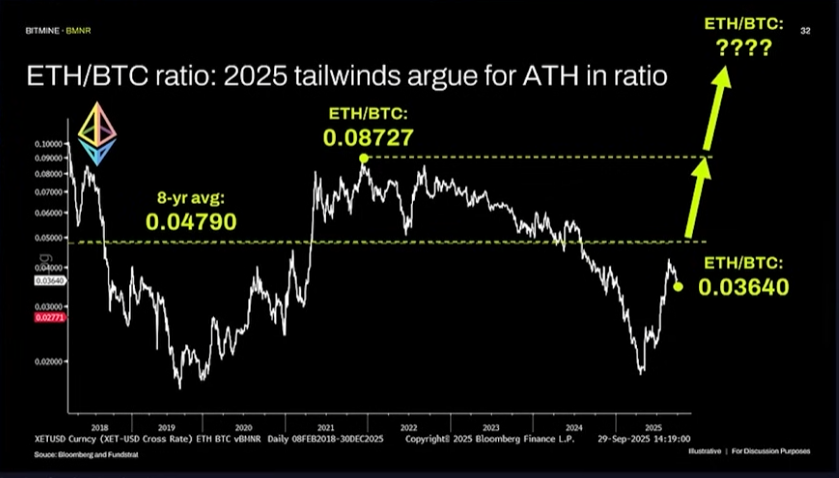

At the TOKEN2049 event in Singapore, Tom Lee says he’s keeping an eye on the performance of Ethereum against Bitcoin (ETH/BTC).

Lee predicts that ETH/BTC will eventually soar to all-time high levels, which it hit in 2021.

“Another chart to think about is Ethereum’s price ratio to Bitcoin. It’s currently at 0.036 BTC, the average has been 0.047, and the high in 2021 was 0.087 BTC…

I think its price ratio should at least recover to its prior high of 0.087 BTC.”

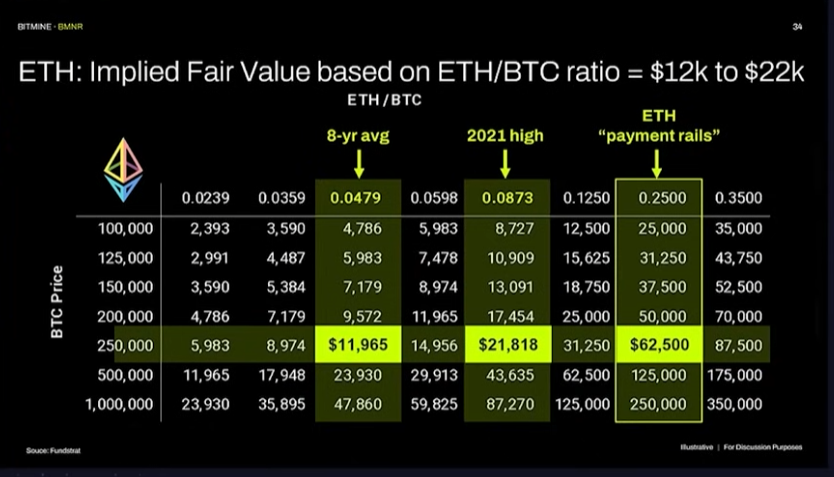

Lee says that he’s looking at the potential dollar upside for Ethereum if Bitcoin hits his $250,000 price target.

“If Ethereum price ratio gets to its eight-year average of 0.0479, that implies 12,000 per Ethereum token. If it gets to its 2021 high, which I think is justifiable given how much is happening fundamentally on Ethereum, that’s $22,000 per ETH.”

Lee emphasizes that the upper limit could extend much higher if Ethereum’s network matures into a dominant global payments infrastructure.

“But I don’t think that’s the ceiling. The ceiling, sorry, another waypoint is that Ethereum becomes the payment rails of the future. And so its network value matches Bitcoin. Well, that would be $62,000 per ETH token.

So with ETH at $4,100, as you can see, each of these three values represents tremendous upside.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.