Investor exuberance over artificial intelligence is fueling a powerful stock rally that Goldman Sachs says is beginning to resemble a FOMO (fear of missing out)-driven surge.

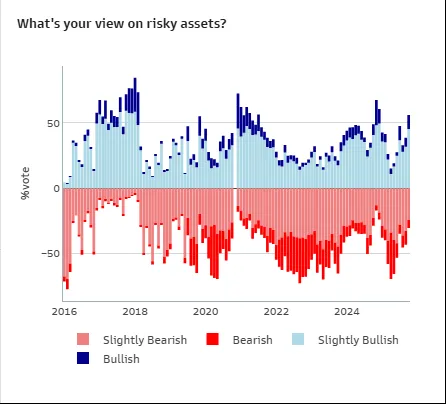

In a new report, Oscar Ostlund, global head of content strategy, market analytics, and data science for Goldman’s digital platform Marquee, says bullish sentiment among clients has climbed to the highest level since December 2024, with 40% expecting the S&P 500 to outperform global peers this month, reports Bloomberg.

The optimism, Goldman warns, has reached a point where fear of missing out may be overtaking fundamentals.

“Not so distant talks about high valuations and ‘bubble’ territory are forgotten as investors are ready to pile back into stocks. FOMO, or the fear of missing out, is starting to creep as the cost of being on the sidelines might be tipping the scales right now.”

The S&P 500 has logged 27 closing records since June, extending a run powered by AI-linked companies and mega-cap technology firms. Despite concerns over valuations, trade tensions, and a softening labor market, investors continue to add exposure.

Ostlund says the FOMO-fueled rallies may continue into year-end, but with rising risk.

“While almost all indicators point up, this setup also increases the probability of rapid unwinds down the road. Buyers beware.”

More than half of the investors Goldman surveyed say they’re still betting the biggest gains will come from AI infrastructure stocks, even as the economy and interest rate outlook stay uncertain.

“Despite the bifurcated economy, with the AI excitement on the one side and a weakening labor market on the other, investors seem content with just two more rate cuts this year.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.