Blackstone’s president Jon Gray says the investment giant is positioning across multiple industries to capture the infrastructure buildout behind artificial intelligence.

Speaking at Blackstone’s 2025 CIO Symposium, Gray describes the rise of AI as a “generational change” and compares the firm’s approach to the historic suppliers of gold rush miners.

He reveals two broad investment themes to ride the AI train.

“Well, it starts with the picks and shovels, with things like chips and data centers and power at massive scale. This is what you need to do to make this AI a reality.”

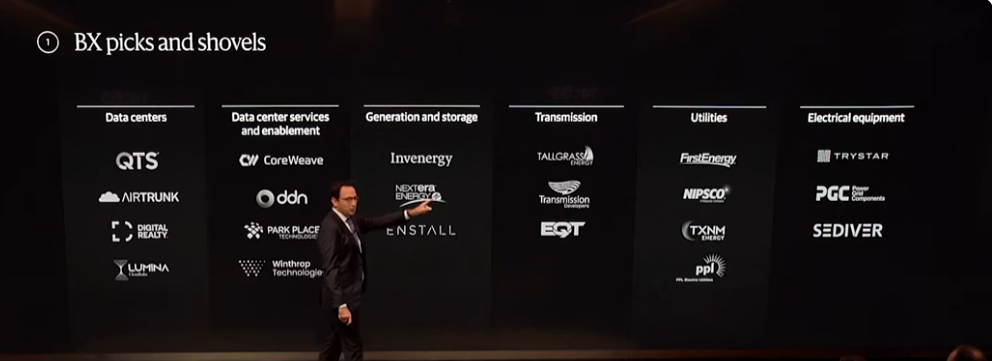

Under the AI investment umbrella, Gray says Blackstone is targeting six key sectors.

“How are we playing this at Blackstone? Well, across the entire spectrum. Data centers in the U.S., Europe, and Asia. All sorts of infrastructure around that. We’ve given billions of dollars to companies like CoreWeave. Renewable energy, generation and storage, transmission, utilities. One of the most boring businesses of all time is now a growth sector. And electrical equipment…

As you build out the grid, lots of companies are going to need to grow and invest. Same thing with utility services. Lots of ways to play picks and shovels.”

In addition to the picks and shovels plays, Gray says Blackstone is also targeting rules-based businesses, which he thinks will be disrupted by AI.

“The one other area that I want to stop on for a sec is what I’ll call rules-based businesses. The marbles come down: are they white, orange, gray? You name it. There are lots of opportunities with these types of companies.

What do I mean by that? Healthcare claims processing. The technology, bringing AI to a company like AGS Health that we recently acquired. Same story with accounting, the ultimate rules-based business. Citrin Cooperman. You can take these legacy businesses and transform them.

And then invest in some of the application software as well. We invested in a company called Norm AI, which is going to make marketing compliance so much more efficient. More and more of our investing is going to be guided in areas like this.”

Blackstone, a global investment firm with more than $1 trillion in assets under management, is headquartered in New York City.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.