Crypto derivatives traders are witnessing more than $10 billion in losses after US President Donald Trump imposed punitive sanctions on China.

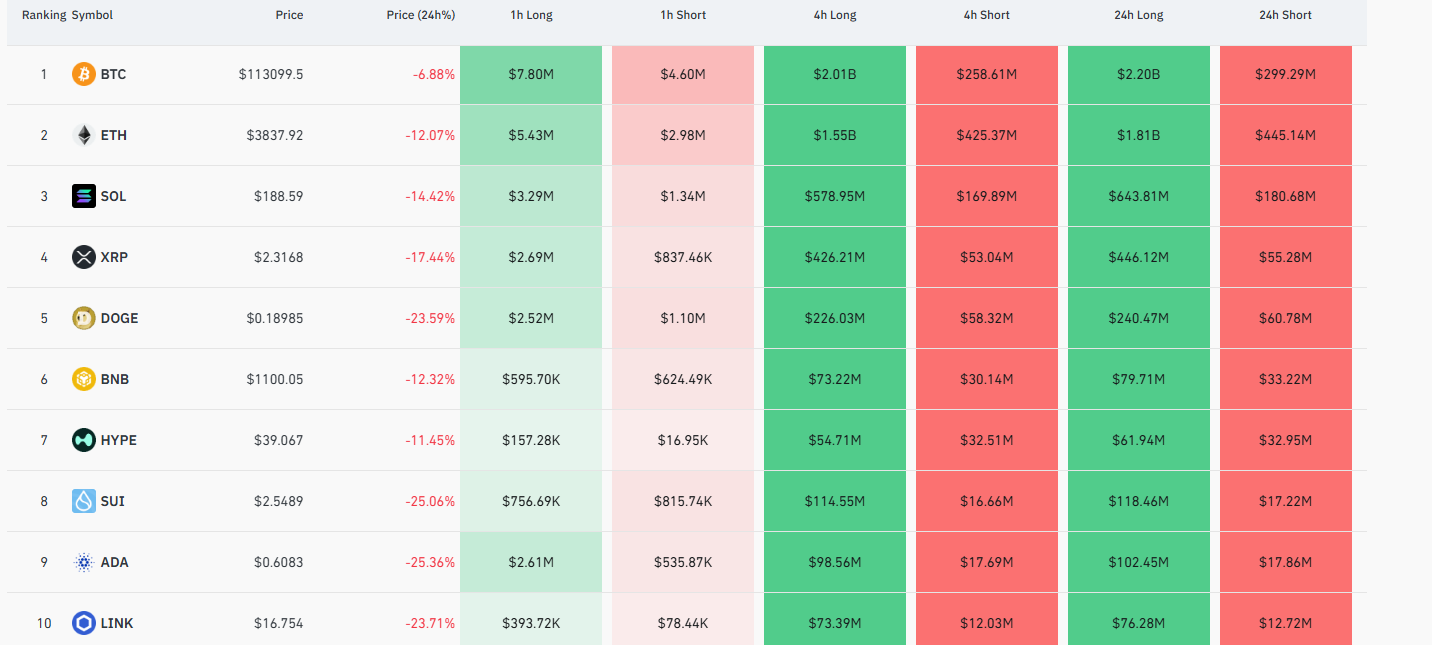

Data from the crypto data aggregator Coinglass shows that in the past 24 hours, 1,528,184 traders were liquidated to the tune of $9.59 billion.

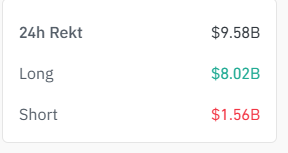

Traders who went long on crypto suffered $8.03 billion in losses, while those trying to short the market added $1.57 billion to the count.

Leading the list is Bitcoin (BTC) with $2.20 billion in longs and nearly $300 million in shorts liquidated in the last 24 hours. Ethereum (ETH) comes in at number two with $1.81 billion in longs and $445.14 million in shorts liquidated over the same stretch. Solana (SOL) traders saw liquidations amounting to $643.81 million in longs and $180.68 million in shorts in the past day.

Bitcoin fell to as low as $102,000 before rallying to $114,000. Ethereum plunged to $3,392 and Solana dropped to $157. Both ETH and SOL bounced and are currently trading at $3,887 and $191, respectively.

The major liquidation event comes as Trump announced massive tariffs against China, saying that the Asian giant is imposing export controls on “virtually every product they make.”

“It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large scale Export Controls on virtually every product they make, and some not even made by them. This affects ALL Countries, without exception, and was obviously a plan devised by them years ago. It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.

Based on the fact that China has taken this unprecedented position, and speaking only for the U.S.A., and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying. Also on November 1st, we will impose Export Controls on any and all critical software.

It is impossible to believe that China would have taken such an action, but they have, and the rest is History. Thank you for your attention to this matter!”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.